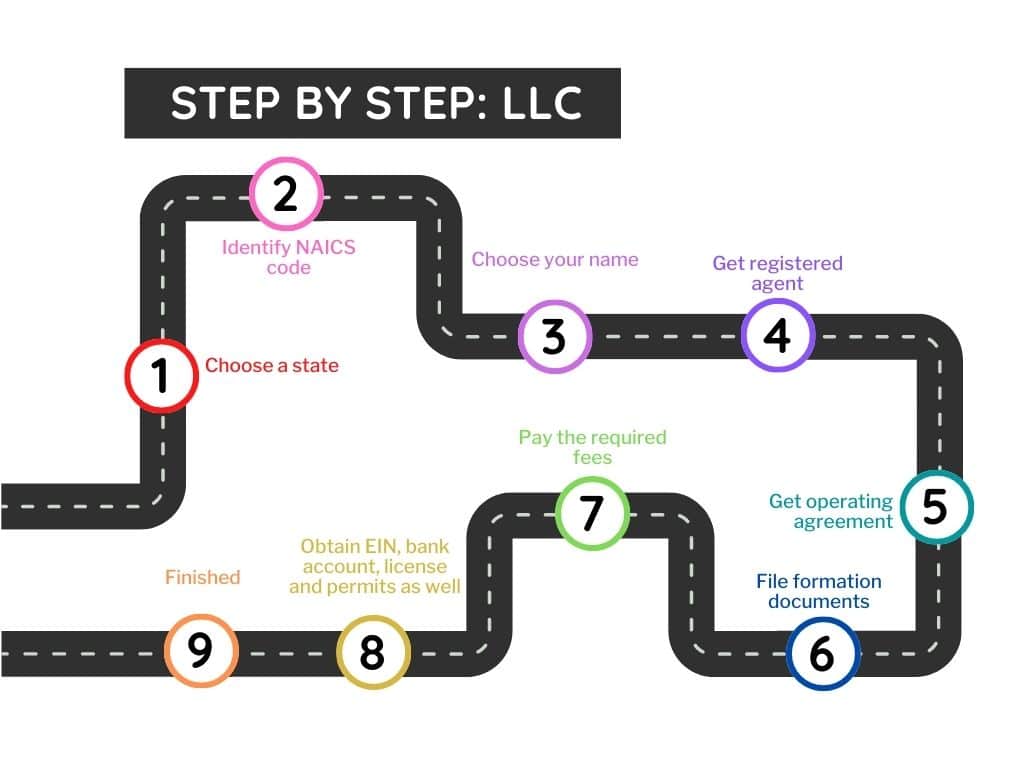

Let’s talk about how one would form an LLC. If you want an overview on what LLC is and why it’s beneficial, here is a LLC overview post.

To form an LLC, you must first decide what state will be the most beneficial. For most, the state they are operating in is the choice because you won’t need to register as a foreign LLC. LLC laws vary from state to state, meaning factors like cost or taxation may be different. One needs to find the state that is the most advantageous for their specific business types.

A Domestic LLC only needs to file in the home state, but a Foreign LLC needs to be filed as well if one is operating at a different state than the one the LLC is registered at. How this is defined can get complex depending on what kind of business you are doing, so I recommend speaking to an expert. Online businesses especially fall into a gray area. This is ultimately to ensure you are following a state regulation.

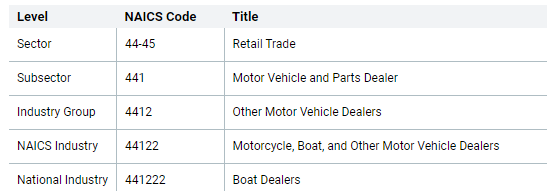

When you are registering an LLC, you will need NAICS code. North American Industry Classification System is the standard used by Federal statistical agencies in classifying business establishments for the purpose of collecting, analyzing, and publishing statistical data related to the U.S. business economy. They are basically codes to define what category of business you fall in. Youtubers and bloggers for example can fall under multiple codes like NAICS Code: 519130 Internet Publishing and Broadcasting and Web Search Portals or 519100 Other information services (including news syndicates & libraries, Internet publishing & broadcasting). Your state government may also use NAICS codes to offer tax incentives to certain industries. If you don’t use the right NAICS code, you may be missing out on these incentives.

Next, you must get a name that isn’t taken. If your name is taken already, you may have to get a DBA (doing business as) after registering your LLC as a different name. For example, your youtube channel already has an established name, but that name may be registered as an LLC already.

Next, you will need a registered agent. They help with legal and tax documents on behalf of LLC. If you don’t have a registered agent and you happen to not properly handle these documents, it can cause the LLC problems.

Next, you will need to have an operating agreement. Operating agreement is simply how the LLC will be operated.

Lastly, you will need to file. To make your new LLC official, you need to file a couple of formation documents like Certificate of Organization, Certificate of Formation, or Articles of Organization with whichever department handles business filings in the state in which you are forming and pay the required fees.

After LLC is filed, one should obtain EIN (employer identification number), open a business bank account, register to do business in other states if required, and gather all licenses and permits.

You must be logged in to post a comment.