Dilution simply means new shares are issued, which results in a decrease in existing stockholders ownership percentage of that company. Dilution is usually done because companies need extra funding, but can be done for other reasons like purchasing another company.

Diluting shares can be good and bad, but mostly it’s bad because it means they don’t have enough capital on hand. The key factor that will decide if it’s bad or good is how the money will be used. If the company uses the new capital to invest in unique opportunities that will drastically increase the value of the company, then it’s good. However, if they need funding to sustain itself, then it’s bad. At the end of the day, stock dilution greatly affects your portfolio, so it’s important to track any information regarding it.

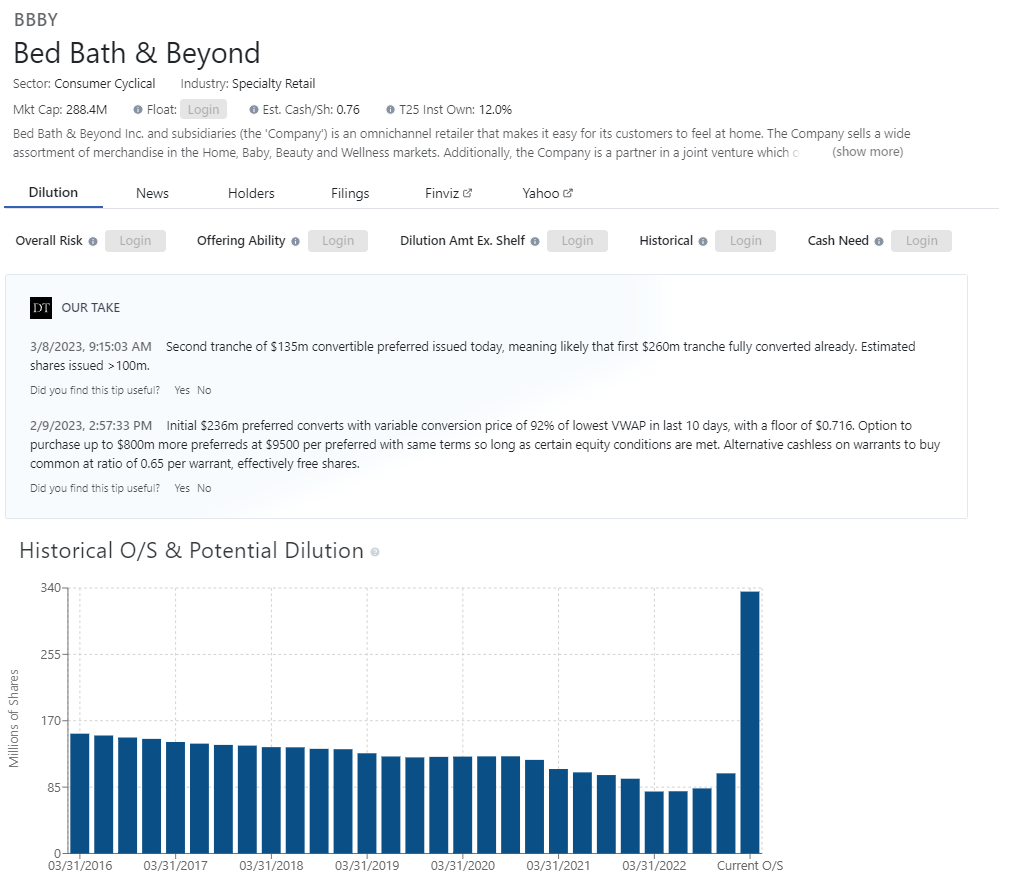

Dilution tracker site offers insight about dilution for numerous tickers. There are already thousands of users using it. It helps to check for possible offerings by looking at remaining shelf capacity or any pending S-1 offerings, get proprietary dilution rating which can tells you probability of it happening, and much more. Ultimately, the tool can help you improve stock selection for your portfolio, make informed calls and increase your rate.

These snapshots are some examples from MULN and BBBY stocks, which are on the list of most known diluted stocks in 2023. As you can see, the tool provides users with their takes on the technical and provide decisional data like completed offerings and its type, method, price, warrants, offering amount, bank, investors, date, and so forth. They have free account as well as premium with 7 days trial, which costs $49 per month as of today.

Note: This is not a financial advice and I am not a financial advisor. I am not paid for this review and this is strictly just informative review of a product that can enhance your lifestyle.

You must be logged in to post a comment.